Apple CEO Tim Cook Refutes Tax Avoidance Claims

John Williamson / 9 years ago

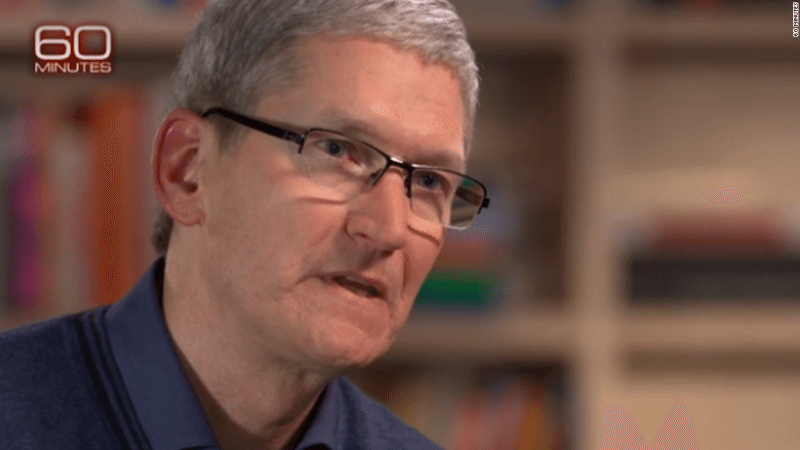

Apple has been accused of tax avoidance and exploiting loopholes in US legislation to move profits to tax havens. For example, Apple’s tax base is in Ireland with a 12.5% corporate rate while the US taxation figure is around 35%. As a result, some critics have argued this is a sophisticated way to either delay paying tax or reduce Apple’s bill. Recently, Tim Cook described the current US tax system in an interview with Charlie Rose on the programme 60 Minutes:

“This is a tax code, Charlie, that was made for the industrial age, not the digital age. It’s backwards. It’s awful for America. It should have been fixed many years ago. It’s past time to get it done.”

Cook became quite aggravated and described the claims of tax avoidance as:

“total political crap.”

He also went onto say that moving the assets into the US would have severe financial implications:

“Because it would cost me 40% [in taxes] to bring it home. And I don’t think that’s a reasonable thing to do,”

Clearly, Tim Cook believes that the current US tax system is completely broken and in need for huge reforms. Not only that, he made bold statements about Apple’s behaviour and the amount of tax they put into the US economy:

“There is no truth behind it. Apple pays every tax dollar we owe,”

“We pay more taxes in this country than anyone.”

This is an interesting statement to make, and the idea that Apple pays a large amount of tax seems fairly credible. However, the amount paid is due to how successful Apple is compared to other companies. What really matters is the percentage of tax paid in regards to Apple’s total earnings. Are they actually paying the full amount, or employing complex schemes to maximize profits? Sadly, I don’t think we will ever know unless there is an independent investigation.

Image courtesy of newspaperplus.com