Apple Reigns Supreme at US Tax Avoidance

John Williamson / 9 years ago

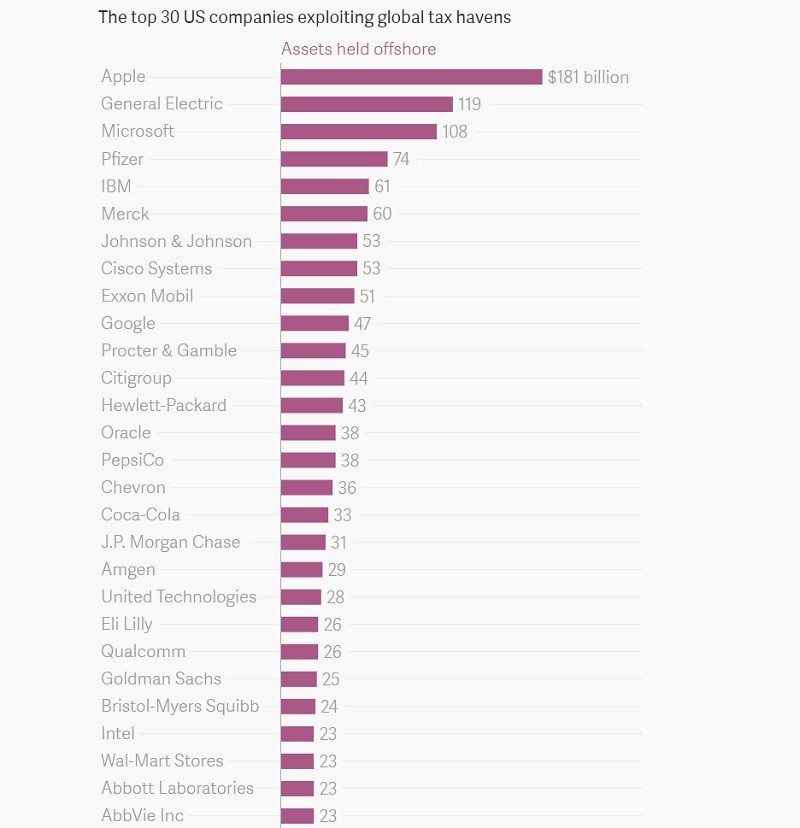

The legality and moral outrage surrounding tax avoidance has been a hotly-discussed topic throughout the world. Many leading corporations from Apple to IBM exploit loopholes in the tax system to reduce their bill and hold assets offshore from their US base. As a result, this net revenue isn’t taxable and allows for increased profits. Sadly, many companies refuse to publicly disclose the nature of moving assets offshore, but new data provides evidence regarding the top 30 US companies who didn’t object to this information going public.

In the US, this data was collated by the Center for Tax Justice’s analysis of SEC filings. As you can see from the graph, Apple came in 1st place moving $181 billion of taxable assets offshore to avoid paying taxation. This is a significant margin ahead of other companies but might simply refer to Apple’s financially strong situation. The chart contains a wealth of technological companies and signifies how tax avoidance is commonplace in the industry. In recent years, governments have promised to clamp down on tax avoidance due to public pressure.

However, very rarely does this result in any meaningful change. Only recently did Amazon start paying corporation tax in the UK after a long period of employing complicated tax schemes. I highly doubt the data will deter people from buying Apple products but it emphaizes how their company and similar technology behemoths are run. From a business standpoint, if a company can maximize their profits, they will within the confines of the law.

How do you feel about technology companies avoiding taxation?

Thank you Quartz for providing us with this information.