Uber Reportedly Operating At Huge Losses

Christopher Files / 9 years ago

San Francisco-based transportation Network Company Uber has been a revelation in terms of market adoption and consumer exposure. But, the key is successful financial management which benefits the long-term viability of a company; this has been placed in a questionable stasis by alleged leaked financial Documents which covey’s a somewhat punishing set of results from Uber’s point of view.

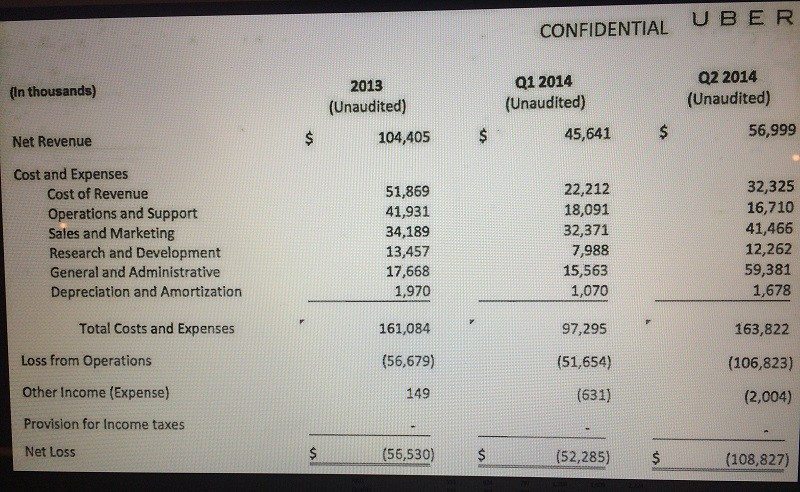

Gawker has purportedly leaked Uber’s financial results which show operating losses of more than $100m (£65m) in the second quarter of 2014, albeit coupled with steady growth in revenue. This is an astonishing figure which is compounded by an astronomical valuation which sets the total value of the company at $50bn; this makes Uber one of the most funded start-ups in the world.

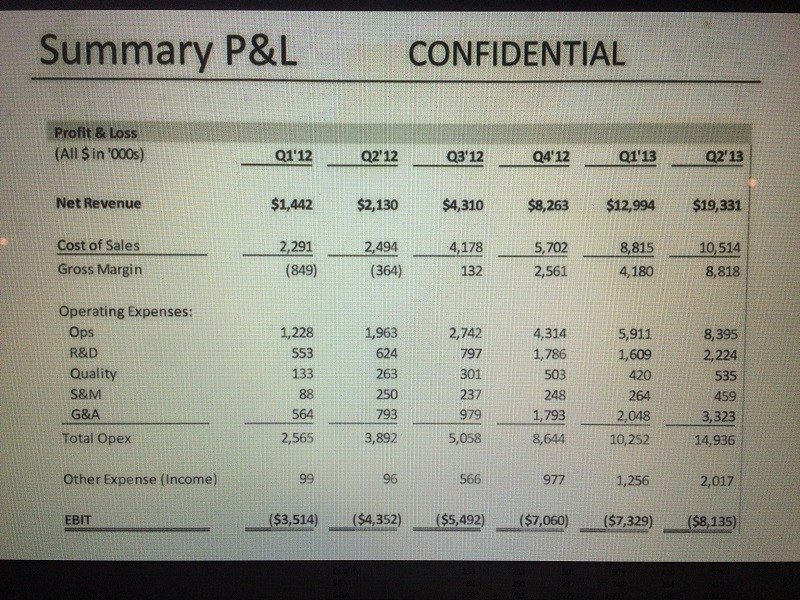

Below is the documents which Gawker have published, now, this slightly confused me too, but eTeknix have clarified the figures. Everything is actually x1000, so when the Net Loss for 2013 is $56,530, this means it is in reality $56 million. The second document lays out quarterly profits and losses in 2012 and part of 2013, this shows healthy revenue coupled with steadily deepening losses. In 2012, Uber’s losses totalled $20.4 million; from the first quarter of 2012 until mid-2013, quarterly losses more than doubled from $3.5 million to $8.1 million.

Uber released a statement which did not deny the existence or the validity of these documents but outlines the following,

“Shock, horror, Uber makes a loss. This is hardly news and old news at that, It’s the case of business 101: you raise money, you invest money, you grow, you make a profit and that generates a return for investors.”

Which is true, any business has to invest capital in order to grow, the only question centres around the point when it becomes unsustainable. For me it’s reckless to value a perceived wealth of a company at such a high figure, it raises expectations to a level to which assets cannot compete. Revenue has to be maximised while minimizing losses, otherwise shareholders will become nervous and sceptical of projected figures which places Uber in a tricky position.

Image courtesy of abc7